Lots of Natural Light

Finished Basement

Large Fenced In Yard

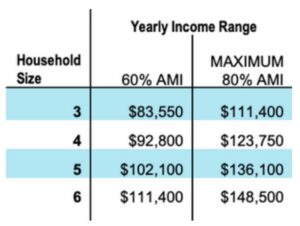

A home that will always be able to be affordable to families at or below 80% of the median family income because it is part of the Douglass Community Land Trust!

The previous owners paid it forward by selling their home at a much-reduced price and leaving several hundred thousand dollars in equity to stay with the home forever. This equity left in the home will be safeguarded by Douglass CLT, which has added even more subsidy to it so that a family at or below 80% MFI will always be able to afford it.

Subsidy initially invested in CLT properties is retained over time, serving generations of homeowners and occupants without requiring increasing subsidies at each successive sale to keep them affordable.

Douglass CLT will keep ownership of the land and sell only the building to the new buyer, issuing a 99-year land lease to the homeowner. That lease contains a resale agreement that says that if/ when they sell their home, the owner will sell at a price affordable to a family at or below 80% MFI.

Yes! First and most importantly, the home purchase should work so that you aren’t paying more too much for housing every month and you are able to save as you see fit.

Second, a Douglass CLT household’s wealth building is no different than other homeowners in that you can build equity by 1)paying down your mortgage loan; 2)getting a tax deduction for the mortgage interest; and 3)benefiting from market appreciation. The difference is that Douglass CLT Pay It Forward homeowners share with the next owner a portion of the increase in home value due to market appreciation. Additionally, owners can get credit for pre-approved physical improvements when they sell. Investment in real estate is never without risk, as no one can predict what will happen in the market, but Douglass CLT also includes safeguards against the worst outcomes if your family hits a rough patch.

Our Resale Formula allows for growth in equity without allowing home price to balloon, making the home affordable for the next purchaser – Paying It Forward!

Interested but not quite ready? Prepare for the next opportunity:

Contact:

1231 Marion Barry Avenue SE, Washington, DC 20020

Phone: 1-202-567-7738